By alphacardprocess December 26, 2025

Accepting ACH payments for gyms has become one of the cleanest ways to collect recurring membership dues, personal training packages, class passes, childcare add-ons, and even retail purchases (like supplements or apparel) without living and dying by card interchange and chargebacks.

When you accept ACH payments you’re pulling funds directly from a member’s bank account using their routing and account number, which is why it’s often preferred for subscriptions and predictable billing.

Gyms and fitness centers have a unique mix of payment needs: high volume recurring billing, seasonal freezes, upgrades/downgrades, family plans, corporate memberships, and membership cancellations that can get messy.

ACH payments for gyms help simplify that complexity because bank payments are built for repeatable, scheduled transactions—exactly what a membership business runs on.

But “set it and forget it” is not the full story. If you want to accept ACH payments for gyms successfully, you need the right setup (processor + gateway), the right authorization language, a strong onboarding flow to reduce bad bank data, and a compliance-aware process that respects consumer protections (especially when billing consumers rather than businesses).

You also need fraud controls that match the latest network direction, like account validation expectations for certain first-use scenarios.

This guide walks you through the full operating playbook—how to accept ACH payments in-person and online, how to automate recurring dues, how to handle returns and disputes, how to stay aligned with network rules, and how gyms can future-proof their payments stack as faster bank rails continue to evolve.

Why ACH Payments Make Sense for Gym Membership Billing

Most gyms don’t just “take payments”—they manage a relationship that repeats every month. That’s where ACH payments for gyms shine. Card billing can work, but cards expire, get replaced, trigger fraud blocks, and create involuntary churn.

Bank accounts change less often than cards, which can mean fewer billing interruptions when you accept ACH payments for monthly dues.

For fitness businesses, the economics matter too. Even small differences in processing costs add up when you’re collecting hundreds or thousands of recurring payments.

ACH payments for gyms are commonly used as a cost-efficient way to bill memberships, especially when average tickets are steady and predictable (for example, $39/month memberships, $149/month boutique studios, or multi-location family plans).

Another big advantage: bank payments can be paired with smart billing logic—like “bill on the 1st,” “prorate the first month,” “retry on NSF,” or “pause during freezes.”

When you accept ACH payments for gyms, you can build a cleaner billing calendar that supports upgrades, downgrades, and freeze policies without constantly chasing members for updated card details.

That said, ACH is not magic. ACH debits can be returned (NSF, closed account, invalid account, etc.). And consumer protections can affect how disputes are handled. So the goal is to use ACH payments for gyms as a durable core payment method—supported by solid authorization, validation, and fallback options—rather than treating it like a shortcut.

ACH Payments for Gyms vs Card Payments: What Changes Operationally

When you accept ACH payments, the process feels similar to cards to the customer (“pay monthly”), but operationally it’s a different rail with different timing, different failure modes, and different member communication needs.

Card transactions typically authorize instantly and settle quickly. ACH debits often take longer to finalize because they move through banking windows and can be returned after the fact.

Same-day options exist, and the per-payment limit for Same Day ACH has been increased over time (commonly referenced at $1 million per payment), while proposals and commentary continue around further expansion.

Here’s what gyms notice first when shifting to ACH payments for gyms:

- Timing & expectations: A member may see a debit pending differently than a card charge. Your front desk and support scripts must explain what members should expect on their bank statement.

- Returns instead of chargebacks: Cards have chargebacks; ACH has return codes and “unauthorized” claims under consumer rules. You need a process for both.

- Authorization is everything: With ACH payments for gyms, your written authorization and your proof of authorization matter. A clean membership agreement and a compliant digital signature flow reduce headaches later.

- Retries and dunning: A gym that’s good at ACH uses controlled retries, pre-notifications, and member outreach rather than repeated blind attempts.

If you design for these differences, accepting ACH payments can reduce churn, reduce processing expenses, and make monthly collections less chaotic.

Key Terms You Need to Understand Before You Accept ACH Payments

To accept ACH payments for gyms without confusion, you need a working vocabulary. These terms show up in processor dashboards, bank return notices, and compliance documentation.

ACH Debit vs ACH Credit

Most gyms use ACH debit for pulling monthly dues from a member’s account. ACH credit is the opposite direction—pushing money out to someone else (like payroll or refunds in some workflows). Your gym’s recurring billing program is usually debit-based.

Originator, ODFI, RDFI

In ACH language, the party initiating entries (your gym, through a provider) is commonly treated as the “Originator.” Banks involved include the sending and receiving institutions that process entries under network rules. Definitions and responsibilities are detailed in the operating rules.

Authorization

Authorization is the member’s permission for you to debit their account. In the gym context, it should clearly describe recurring debits (amount or how it’s determined), timing, and cancellation procedures. Your authorization workflow is one of the most important building blocks when you accept ACH payments.

Returns and Return Codes

ACH debits can come back as returns (for example, insufficient funds, invalid account, account closed). Your billing system should track return codes, retry logic, and member outreach.

Same Day ACH

Same Day ACH refers to ACH entries processed in same-day windows (banking days). Limits and capabilities have expanded over time, and industry discussion continues on raising the per-payment limit further in coming years.

Once your team understands these concepts, ACH payments for gyms stop feeling “mysterious” and start feeling like a predictable system you can manage.

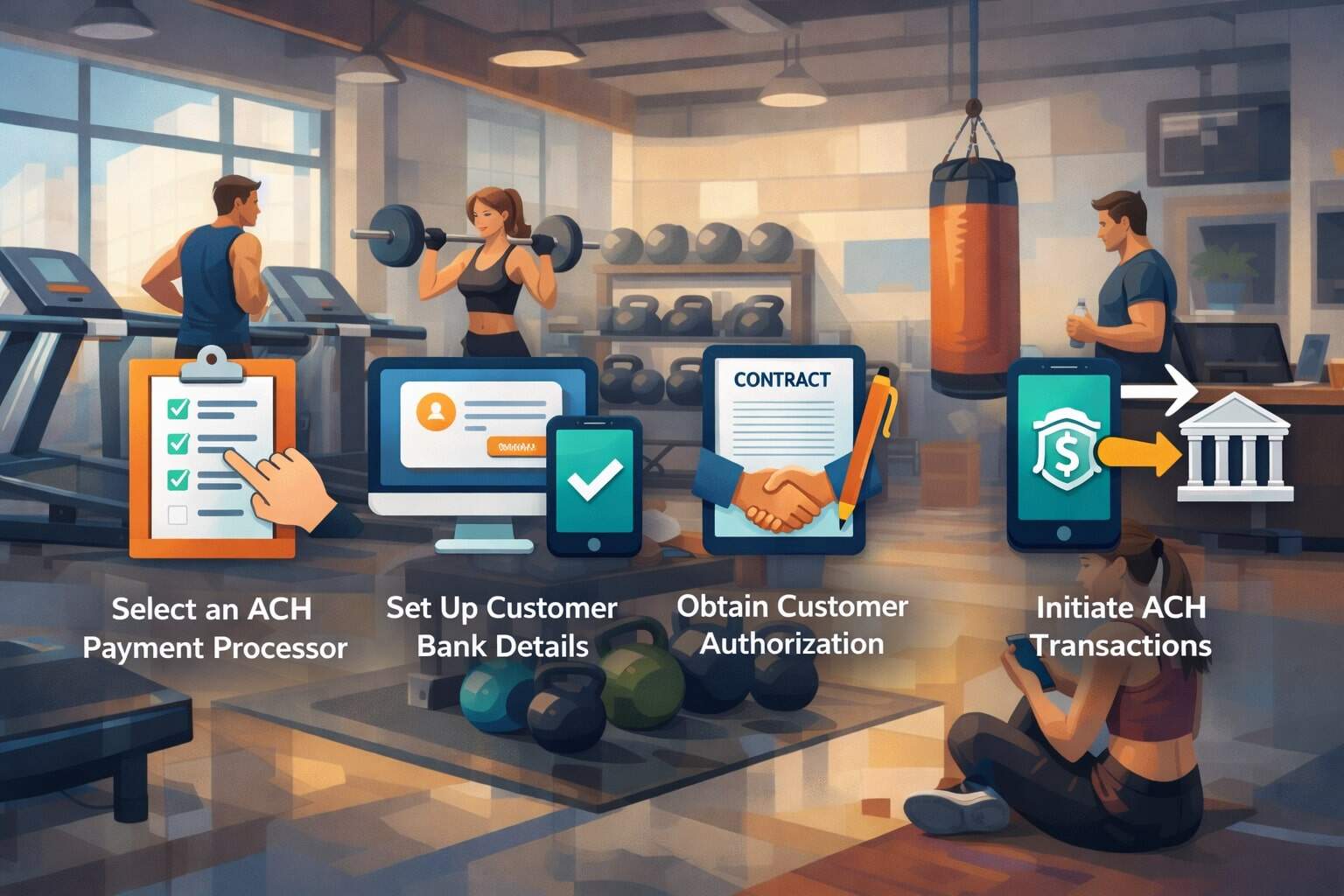

Step-by-Step: How to Accept ACH Payments for Gyms (The Core Setup)

If you want to accept ACH payments for gyms, you need more than a bank account and a membership form. You need an end-to-end stack that includes a provider, a secure method to capture bank details, a billing engine, and reporting that supports member service.

1) Choose an ACH-capable provider built for recurring billing

Look for a provider that supports:

- Recurring schedules (monthly, weekly, annual, custom)

- Membership pauses and prorations

- Tokenization (so you don’t store raw account numbers)

- Account validation options (especially for first-use, web-captured consumer accounts)

- Clear reporting for returns and re-presentments

Account validation has become a bigger focus as fraud patterns evolved, and network guidance has added expectations for validating certain first-use consumer account information in web contexts.

2) Connect your gym management software or billing system

Many gyms use management platforms for check-in, class scheduling, and membership billing. Your ACH provider should integrate smoothly so your staff isn’t double-entering members.

3) Build a secure bank account capture flow

You can capture bank info:

- Online during signup (member portal)

- In person at the front desk (secure link or device)

- Over the phone (careful: recorded consent and secure entry are essential)

4) Turn on automated billing + receipts

When you accept ACH payments, you want automated receipts and real-time status updates (“scheduled,” “processing,” “paid,” “returned”). This reduces support tickets.

5) Define your returns and collections workflow

Decide:

- How many retries you allow

- When you switch to a backup card on file

- When you freeze access

- How you communicate (SMS/email scripts)

A gym that masters these basics can accept ACH payments for gyms at scale with fewer cancellations and fewer billing surprises.

Collecting Bank Authorization the Right Way for Gym Memberships

A gym’s ACH success is directly tied to how clean its authorization process is. When you accept ACH payments for gyms, authorization is your foundation for recurring debits and your defense when a member claims they didn’t approve the transaction.

What your authorization should clearly include

Your membership authorization language should cover:

- The member’s consent to recurring debits

- The schedule (e.g., monthly on the 1st, or monthly based on signup date)

- The amount or how the amount is determined (fixed dues, or variable based on add-ons)

- How cancellations work (deadline rules, notice requirement)

- Fees that may apply (late fee, return fee—if permitted and disclosed)

- How the member can revoke authorization

Digital signatures and audit trails

If signups happen online, you want:

- Timestamped consent

- IP address/device or equivalent audit trail

- A stored copy of the authorization language accepted

- Easy retrieval in case of disputes

Consumer protections matter

For consumer accounts, electronic fund transfer rules and related protections can limit consumer liability for unauthorized transfers and establish investigation and error resolution expectations for financial institutions.

This is one reason gyms should keep a clean proof-of-authorization record when they accept ACH payments.

Best practice for gyms

Treat ACH authorization like you’d treat liability waivers: consistent language, easy retrieval, and built into every sales channel (online, in-person, corporate, referral promos). The better your authorization, the smoother your ACH payments for gyms program runs.

Bank Account Validation and Fraud Controls for ACH Payments for Gyms

Fraud and bad bank data are the silent killers of ACH programs. The goal is not to make signup harder—it’s to reduce returns, reduce unauthorized claims, and keep approval rates healthy.

As network risk controls evolve, account validation for certain use cases has become a key theme, especially validating first-use consumer account information captured in web contexts.

Common validation methods gyms can use

When you accept ACH payments for gyms, your provider may offer:

- Instant account verification (bank login or credential-less methods)

- Micro-deposits (slower but effective; member confirms small deposit amounts)

- Database or risk checks (signals tied to account status or consistency)

A practical approach is to use instant verification during online signup (to reduce drop-off) and micro-deposit as a fallback when instant verification fails.

Fraud controls that fit fitness businesses

Gyms have patterns fraud tools can use:

- New signup + high-ticket add-on + immediate cancellation request

- Multiple signups from the same device

- Mismatched name vs account owner

- Unusual billing frequency changes

Policies to reduce “friendly fraud”

“Friendly fraud” happens when a member forgets, disputes out of frustration, or claims they didn’t authorize after canceling incorrectly. Gyms reduce this by:

- Sending clear pre-bill notifications

- Stating cancellation deadlines plainly

- Sending receipts immediately after billing

- Logging every interaction

Fraud controls aren’t just for big chains. Even boutique studios benefit because fewer returns means more predictable cash flow, and predictable cash flow is the entire point of ACH payments for gyms.

Recurring Billing Design: Membership Dues, Freezes, Upgrades, and Add-Ons

A gym’s billing model is rarely static. Members switch tiers, pause during travel, add family members, buy training packs, or join challenges. Your recurring billing system must handle these changes without creating “billing chaos.”

Billing schedules gyms typically choose

Common options when you accept ACH payments:

- Calendar billing (everyone billed on the 1st or 15th)

- Anniversary billing (billed based on signup date)

- Hybrid (initiation fee upfront, then recurring on a calendar date)

Calendar billing is easier to reconcile; anniversary billing can feel more “fair” to members. The best choice depends on your membership volume and staff capacity.

Freezes and holds

If you offer freezes, define:

- Freeze fee (if any)

- Maximum freeze length

- Whether billing pauses completely or changes to a reduced “hold” rate

- Reactivation rules

Upgrades, downgrades, and prorations

When you accept ACH payments for gyms, the cleanest approach is:

- Apply upgrades immediately with prorated difference

- Apply downgrades at next billing cycle

- Send clear confirmation receipts so members understand what changed

Add-ons and variable billing

If amounts vary (like training sessions added mid-month), you’ll want:

- Clear authorization language allowing variable amounts, or a separate authorization per add-on

- Pre-bill notice for variable debits (reduces complaints)

A well-designed recurring structure is what turns ACH payments for gyms into a predictable revenue engine rather than a monthly scramble.

Handling ACH Returns: NSF, Closed Accounts, and Invalid Details

Returns are normal in ACH. The difference between a messy gym billing program and a smooth one is how returns are handled operationally. When you accept ACH payments, plan for returns upfront.

The most common return scenarios in gyms

- NSF (insufficient funds): Usually temporary; retry logic can solve it.

- Closed account: Member changed banks; needs updated info.

- Invalid account/routing: Data entry errors; validation reduces this.

- Stop payment: Often signals dissatisfaction or cancellation confusion.

A smart retry strategy

Good gym programs typically:

- Retry once after a short delay

- Retry a second time only if your provider and rules allow and the member hasn’t asked you to stop

- Notify the member before each attempt

- Offer self-service update links

The key is to avoid “machine-gunning” retries that irritate members or trigger compliance issues.

Fees and communication

If you charge a return fee, disclose it clearly at signup and in the membership agreement. Keep your messaging calm and direct:

- “Your scheduled membership draft didn’t go through.”

- “Here’s a link to update your bank details.”

- “We’ll retry on X date unless you update sooner.”

A thoughtful returns workflow protects the gym’s revenue while maintaining member trust—exactly why businesses adopt ACH payments for gyms in the first place.

Member Cancellations, Disputes, and “Unauthorized” Claims

This is where many gyms get nervous about ACH. The truth: you can run a strong ACH payments for gyms program if your cancellation policy is clear, your authorization is documented, and your communication is consistent.

Cancellation policy design that reduces disputes

Strong gym policies typically include:

- Clear cancellation channels (in-person, email, portal)

- A defined cutoff date (e.g., cancel by the 25th to stop next month)

- Confirmation message after cancellation

- Refund rules (or “no refunds after processing” rule) that are communicated up front

“Unauthorized” claims and consumer protections

For consumer accounts, rules and protections around unauthorized electronic transfers can apply, and consumer liability limits are addressed under applicable regulations. This is a major reason to store proof of authorization and provide members with clear receipts.

What gyms should do when a claim happens

- Pull the member’s authorization record

- Pull the membership agreement version they accepted

- Pull cancellation timestamps and communication logs

- Provide a concise timeline for internal review

- Offer a reasonable resolution when appropriate (sometimes a partial refund saves a long dispute)

The goal is not to “win every dispute.” The goal is to prevent most disputes through clarity and to resolve the few that occur with documentation and professionalism—so you can keep accepting ACH payments confidently.

Pricing, Fees, and What to Negotiate When You Accept ACH Payments

Costs vary widely depending on volume, average transaction size, and risk profile. When gyms adopt ACH payments for gyms, they often focus on “lower cost than cards,” but the better approach is “predictable costs with high approval rates.”

Typical ACH fee structures you may see

- Flat fee per transaction (common for debits)

- Percentage + flat fee (less common but exists)

- Monthly platform or gateway fee

- Batch fees or file fees (legacy setups)

- Return fees (processor charges for returns)

What gyms should negotiate

If you process meaningful volume, negotiate:

- Per-transaction pricing at volume tiers

- Return fee pass-through vs marked-up returns

- Waived monthly minimums (if seasonal)

- Support SLAs (important when billing issues affect member access)

Hidden cost: involuntary churn

A cheap rate means nothing if your system creates failed payments. When you accept ACH payments, prioritize:

- Account validation tools

- Good retry logic

- Clean member communication

A gym’s best “rate” is the one that collects the most revenue with the fewest support tickets.

Security and Compliance Essentials for ACH Payments for Gyms

Gyms handle sensitive data—member identities, banking details, and sometimes health-adjacent information (like training notes). When you accept ACH payments for gyms, you want to reduce your data exposure while staying aligned with network expectations.

Tokenization and data minimization

Do not store raw routing/account numbers in spreadsheets or local systems. Use tokenization through your provider so staff never sees full bank details after onboarding.

Role-based access

Front desk staff should not have the same permissions as finance admins. Limit who can:

- Export payment reports

- Change billing schedules

- Edit bank tokens

- Issue refunds

Rule alignment and risk management

Network rules and updates focus heavily on reducing fraud and improving validation practices, and the operating rules are maintained with effective-date tracking.

For gyms, practical compliance means:

- Clear authorization language

- Document retention for consent and notices

- Strong verification for online signups

- Quick response to member billing questions

Security is not a one-time checklist. It’s an operating habit that keeps ACH payments for gyms stable long-term.

In-Person vs Online: Best Ways for Gyms to Capture ACH Enrollment

Gyms sell memberships everywhere: at the front desk, at a pop-up table, through social ads, through referral links, and via corporate partnerships. If you want to accept ACH payments consistently, your enrollment experience has to work in every channel.

In-person enrollment (front desk)

Best practice is a secure digital capture method:

- Tablet-based signup in your CRM/portal

- A secure link sent by SMS/email during signup

- ID checks for certain higher-risk scenarios (optional, policy-based)

Avoid writing bank details on paper. Not only is it risky—it also increases typos, which increases returns, which makes ACH payments for gyms feel unreliable.

Online enrollment (website + ads)

Online enrollment should emphasize:

- Instant verification when possible

- A simple “one minute” flow

- Immediate confirmation of membership and billing date

- Clear cancellation and freeze policy links

Phone enrollment

The phone can work, but it’s higher risk operationally. If you must do it:

- Use a secure hosted payment page while the member is on the phone

- Document the member’s consent

- Send a follow-up summary email immediately

A consistent enrollment design reduces bad data and reduces disputes—two of the biggest factors in a successful ACH payments for gyms program.

Accounting, Reconciliation, and Reporting for Fitness Businesses

One reason operators love ACH payments for gyms is predictable revenue—but only if reporting is clean. Your finance workflow should answer:

- What was billed today?

- What’s pending vs settled?

- What returned, and why?

- What was reattempted?

- What’s the outstanding member balance?

Reconciliation habits that reduce month-end pain

- Reconcile daily batches (or daily settlement summaries)

- Tag member accounts with billing status

- Separate membership revenue from retail and add-ons

- Track returns as their own category (not as “negative revenue confusion”)

Access control and audit trails

Every billing change should log:

- Who changed it

- When it changed

- What changed (amount, date, member tier)

Forecasting

With ACH payments for gyms, forecasting becomes more reliable because membership collections follow a schedule. Your forecast should include:

- Expected billing run totals

- Expected return rate (your historical average)

- Expected recoveries from retries

Good reporting isn’t glamorous, but it’s what turns accepting ACH payments into a dependable operational system.

Marketing and Member Adoption: How to Get More Members to Choose ACH

Even if you support ACH, members won’t automatically pick it. The gym needs a simple adoption strategy that makes ACH payments for gyms feel normal and beneficial.

Position ACH as “bank draft” with benefits

Members respond to:

- “Avoid card expiration issues”

- “More reliable monthly billing”

- “Fewer missed payments = uninterrupted access”

- “Optional: discounted enrollment fee when using bank draft” (if you choose)

Incentives that actually work

Common gym incentives:

- Waived initiation fee for bank draft enrollment

- Small monthly discount for ACH autopay

- Free guest pass after 3 successful drafts

Reduce friction at signup

The biggest adoption killer is friction. Use:

- Simple enrollment language

- Fast verification

- Immediate confirmation of next billing date

If you want strong adoption, train staff to explain ACH in one sentence and move forward. The easier it feels, the more members will choose ACH payments for gyms.

Future Trends and Predictions for ACH Payments in Membership Businesses

The next few years will continue to favor bank-based payments for recurring services. When you accept ACH payments, you’re aligning with a long-term direction: more account validation, better risk controls, and faster settlement options.

Continued expansion of faster ACH capabilities

Same Day ACH has expanded over time with higher per-payment limits, and industry proposals and commentary have discussed further raising those limits with potential effective dates in the coming years.

For gyms, this matters less for monthly dues (which don’t require same-day speed) and more for:

- High-ticket annual memberships

- Franchise fee collections

- Large corporate wellness contracts

- Rapid recovery of failed payments

Stronger emphasis on validation and fraud reduction

Account validation expectations for first-use consumer bank information in web contexts are a clear signal: the network and banks want fewer fraudulent debits and fewer avoidable returns.

Gyms that invest early in validation tools will likely see:

- Lower return rates

- Fewer “unauthorized” issues

- Better long-term approval rates

More “bank pay” choices for consumers

Members increasingly expect modern “pay from bank” options. ACH remains central for recurring billing, and it’s likely to be paired with faster bank experiences and better onboarding UX. The gym operators who win will be the ones who make bank payments easy, transparent, and reliable.

FAQs

Q.1: Is ACH a good option for monthly gym memberships?

Answer: Yes. ACH payments for gyms are commonly used for recurring memberships because bank accounts change less often than cards, which can reduce failed payments and involuntary churn. The key is to pair ACH with clean authorization, validation, and a clear cancellation policy so disputes stay low.

Q.2: How long do ACH payments take to process for a gym?

Answer: Timing depends on the type of ACH entry and banking windows. Standard processing can take multiple business days, while same-day processing can be available in certain scenarios and within network windows. Same Day ACH capabilities and limits have expanded over time, and discussion continues on further expansion.

Q.3: What happens if a member’s ACH payment is returned to NSF?

Answer: Your gym receives a return, and your billing system should flag the member, notify them, and follow a controlled retry policy. The best ACH payments for gyms workflows also offer a self-serve link to update bank details or switch to a backup payment method to restore the account quickly.

Q.4: Can members dispute ACH payments the way they dispute card payments?

Answer: Dispute mechanics differ. Cards use chargebacks; ACH uses returns and “unauthorized” claims pathways that can involve consumer protections. This is why proof of authorization, clear receipts, and consistent member communication are critical when you accept ACH payments.

Q.5: Do gyms need account validation to accept ACH payments online?

Answer: While not every scenario is identical, validation has become a major best practice—especially for first-use consumer account information captured online. Using verification tools helps reduce fraud and avoidable returns and aligns with evolving network risk expectations.

Q.6: Should a gym offer both ACH and card payments?

Answer: Usually, yes. Many gyms lead with ACH payments for gyms for recurring dues and keep cards as a backup or for retail and drop-in purchases. A dual-option strategy increases approvals and reduces churn because members have a fallback if one method fails.

Q.7: What is the best way to get members to choose ACH?

Answer: Make it easy and explain it simply. Offer fast enrollment, clear billing dates, and optional incentives (like a waived initiation fee). The more frictionless the experience, the higher your adoption of ACH payments for gyms.

Conclusion

If your gym depends on recurring membership revenue, learning how to accept ACH payments for gyms is one of the highest-impact operational upgrades you can make. ACH fits the membership model: predictable scheduling, lower payment method churn, and strong alignment with recurring billing automation.

The gyms that succeed with ACH payments for gyms don’t treat it as “just another payment type.” They treat it as a system: secure enrollment, clear authorization, validation to reduce bad bank data, a calm returns workflow, and member communication that prevents friendly fraud and confusion.

They also stay aware of network direction—like increasing focus on account validation for certain first-use consumer web scenarios and the broader trend toward expanding faster ACH capabilities over time.

Most importantly, they design the member experience so it feels effortless: sign up quickly, know exactly when billing happens, and get instant confirmation.

When you do that, accepting ACH payments becomes a reliable engine that supports growth—more stable collections, fewer failed payments, and a cleaner relationship between your gym and your members.