Running a modern facility means you’re not just swiping cards at the front desk. You’re managing memberships, class packs, personal training, retail, waivers, recurring billing, late fees, upgrades, refunds, chargebacks, and daily reconciliation—often across multiple locations and multiple sales channels. The right gym POS system becomes the operational “brain” that...

Best Payment Solutions for Gyms

Modern gyms don’t just sell memberships—they sell convenience, consistency, and community. That’s why payment solutions for gyms matter as much as your equipment, trainers, and programming. If members can’t pay the way they want (or if billing is confusing), they churn faster. If your checkout experience is clunky, you lose...

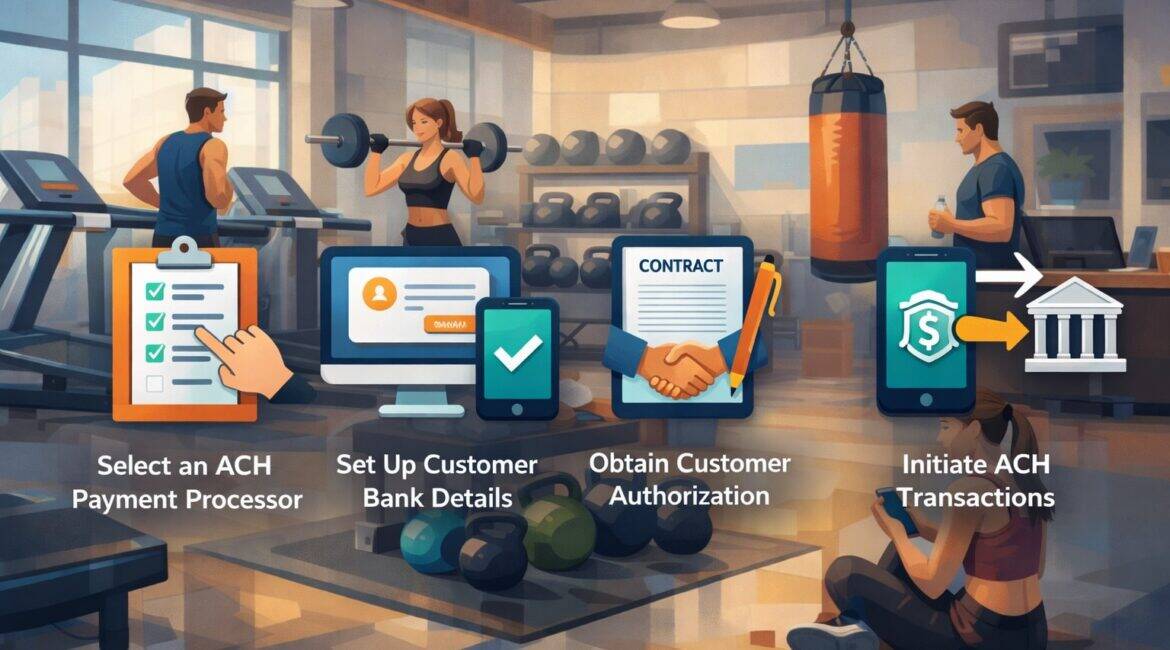

How to Accept ACH Payments for Gyms & Fitness Centers

Accepting ACH payments for gyms has become one of the cleanest ways to collect recurring membership dues, personal training packages, class passes, childcare add-ons, and even retail purchases (like supplements or apparel) without living and dying by card interchange and chargebacks. When you accept ACH payments you’re pulling funds directly...

ACH Payment Processing for Gyms & Fitness Centers

ACH payment processing for gyms and fitness centers has become a core way to collect membership dues, personal training fees, class packs, and even retail add-ons with lower processing costs and fewer chargeback headaches than many card-heavy setups. When you run a gym, cash flow stability matters more than flashy...

How to Prevent Chargebacks in the Fitness Industry

Chargebacks hurt fitness businesses more than most people realize. They don’t just reverse a single gym membership payment or personal training session. They create fees, increase your processing costs, threaten your merchant account, and erode trust with members. Learning how to prevent chargebacks in the fitness industry is now a...

How to Avoid Hidden Fees in Gym Payment Processing

Gym payment processing is a fact of life for fitness businesses in the United States, but hidden costs don’t have to be. Most gyms know they’ll pay a percentage on every card transaction, usually somewhere around 1.5%–3.5% plus a small per-transaction fee. What many owners don’t realize is that junk...

How to Reduce Credit Card Processing Costs at Your Gym

Credit card payments are the lifeblood of most gyms in the US. Members expect to pay monthly dues, personal training packages, and retail purchases with cards on file or tap-to-pay wallets. But as convenient as this is, credit card processing costs at your gym can quietly eat into your profit...

Understanding Credit Card Fees in the Fitness Industry

Credit card fees in the fitness industry quietly eat away at profit margins for gyms, studios, and trainers. Every time a member pays a monthly membership, buys a class pack, or pays a drop-in fee, your business pays a percentage plus a small fixed fee. For many fitness businesses in...

How POS Systems Simplify Gym Check-In and Sales

Modern gyms in the United States are no longer just rooms full of treadmills and dumbbells—they’re full-on membership businesses that depend on smooth check-ins, fast payments, and accurate membership management. That’s exactly where POS systems come in. Today’s gym POS systems don’t just take payments; they simplify gym check-in and...

Cloud-Based POS Systems for Fitness Businesses

Cloud-based POS systems for fitness businesses have rapidly become the backbone of modern gyms, studios, and wellness centers across the United States. Instead of relying on clunky, on-premise software and paper sign-in sheets, fitness owners now use cloud-based POS platforms to handle everything from memberships to payroll. A cloud-based POS...